does indiana have estate or inheritance tax

In Indiana there are several ways that estate administration can be handled depending on the level of supervision required and the amount of assets in the estate. Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013.

Leonardo Soto Sobreyra Greater Chicago Area Professional Profile Linkedin

Estate Tax Indiana repealed the estate or inheritance tax for all those who die after December 31 2012.

. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary. While Federal Estate Tax is assessed on a decedents total combined asset value Indiana Inheritance Tax is a transfer tax assessed on each separate transfer. Indiana has a very tax friendly state.

Indiana Does Not Have an Inheritance Tax Anymore February 9 2016 Estate Planning Estate Tax Taxes People sometimes hear bits and pieces about estate planning topics and they go forward with certain misconceptions. But make sure you do your tax planning. Indiana does not have an inheritance tax nor does it have a gift tax.

In general estates or beneficiaries of Indiana residents are required to file an inheritance tax return Form IH-6 if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary. Even though there is a state tax assessment there is no inheritance tax estate tax or gift tax. In general estates or beneficiaries of.

Therefore no inheritance tax returns must be filed at this time. Indianas inheritance tax still applies. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012.

Indiana inheritance tax was eliminated as of January 1 2013. Tennessees estate tax will phase out fully in. Just because you dont have an estate tax at the Indiana level you could find that you have it at the federal level.

Of course Indiana cannot change federal law and there does remain in existence a Federal Estate Tax. As a result Indiana residents will not owe any Indiana state tax after this date with respect to transfers of property and assets at death. If property is owned in other states there is the possibility that such property may be subject to the estate tax of the other state.

In 2021 the credit will be 90 and the tax phases out completely after December 31 2021. Indiana is one of 38 states in the nation that does not have an estate tax. 2021 Estate Tax Exemption For people who pass away in 2021 the exemption amount will be 117 million its 1158 million.

For individuals dying before January 1 2013. To the extent that there is any good news about a tax because of the credits available to an Estate Estates with assets of less than 525 million will not be subject to that tax. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022.

We endeavor to clear up some of these misunderstandings from time to time and we will address one of them in this blog post. There is no inheritance tax in Indiana either. Indiana Inheritance Tax is imposed on the transfer of property from an Indiana decedent to a beneficiary.

Reform and repeal of estate and inheritance taxes have been very frequent in the last few years sometimes in states you might not expect. This is great news if you live in the Hoosier state. What is the estate tax exemption for 2021.

However other states inheritance laws may apply to you if someone living in a state with an inheritance tax leaves you money or property. In 2013 Indiana sped up the repeal of its inheritance tax retroactively to January 1 2013. The transfer of a deceased individuals ownership interests in property including real estate and personal property may result in the imposition of inheritance tax.

Are required to file an inheritance tax return Form IH-6 with the appropriate probate court if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary.

Do I Have Rights As The Beneficiary Of A Trust Indianapolis Estate Planning Attorneys

Indiana Income Tax Calculator Smartasset

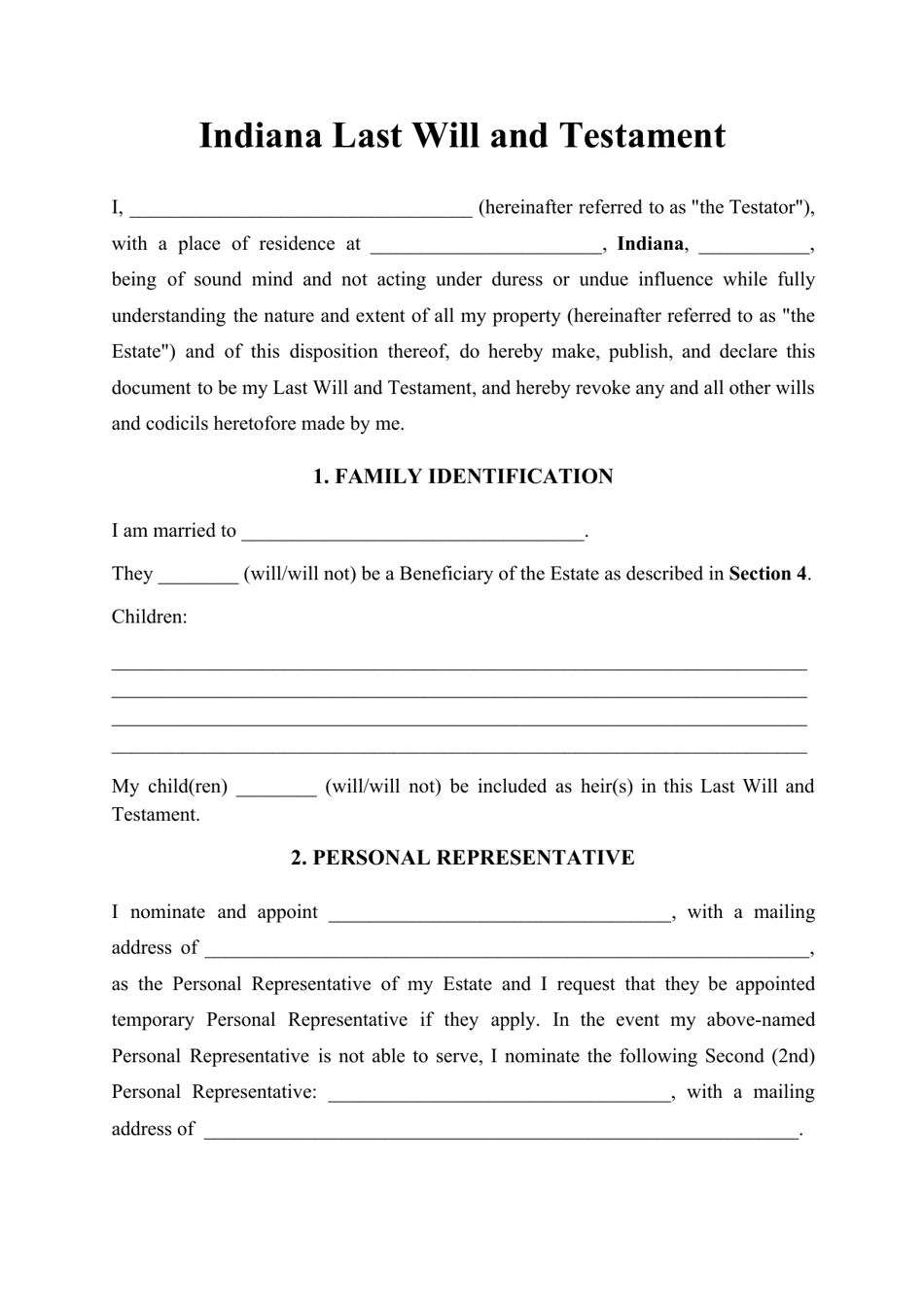

Indiana Last Will And Testament Template Download Printable Pdf Templateroller

What You Actually Take Home From A 50 000 Salary In Every State Gobankingrates

Indiana Last Will And Testament Legalzoom

Is Property Tax The Same As Paying Rent To The Government Can I Actually Own Property In The United States Quora

Official Map Of The City Of Indianapolis And Its Environs

Is Indiana A Community Property State Avnet Law

Taxes And Incentives Southwest Indiana Megasite

Indiana Income Tax Calculator Smartasset

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Is Property Tax The Same As Paying Rent To The Government Can I Actually Own Property In The United States Quora

What To Do When You Inherit Property Indiana Law Firm Hocker Associates Llc

If A Beneficiary Dies During Probate What Happens To The Inheritance Indianapolis Estate Planning Attorneys

Women Make 3 Key Investing Mistakes Investing Start Investing Bond Funds

Indiana Income Tax Calculator Smartasset

What Is A Step Up In Basis Indianapolis Estate Planning Attorneys